Let’s talk bonds! In particular, bond yields. It is frequently said that the only asset class you should believe are bonds. Bond yields have been seen moving higher these last couple of days/weeks and are in the process of resolving higher after almost 10 months of sideways action. What does this mean for equities? What do you think about when you hear about rising interest rates? I think of inflation and when I think of inflation I’ll usually take a look at energy, banks, and maybe some real estate...

Here are the 4 major bond yields all in the process of trending higher after moving sideways for more than nine months.

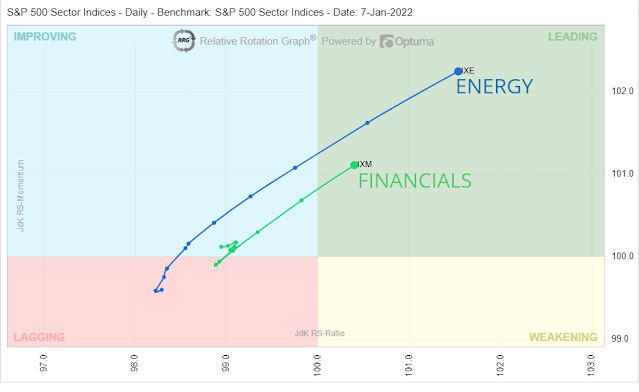

What does this mean for equities? Usually we'll see strength in energy and financials. Below you can find the RRG for the energy and financials sector, both are currently leading the market and show no sign of weakness, for now.

FINANCIALS

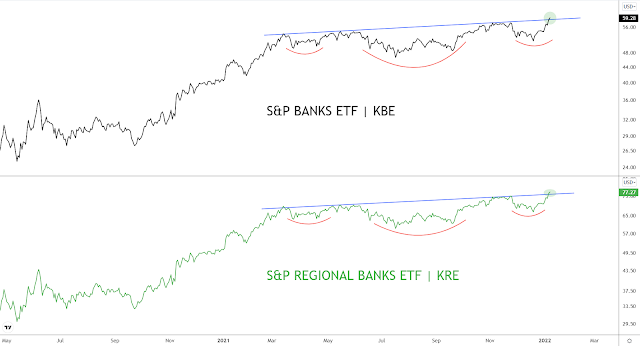

The two important ETFs for banks KBE and KRE are both resolving higher after a couple of months of choppiness. They don't have textbook breakouts, but the strength is still clear.

We get some more added confluence when we take a look at the 2s/10s spread. This is one that you want to see move higher if you're interested in taking positions in bank stock. In short, the wider the spread the more money banks make.

I've been talking about banks only, but financials as a sector has been performing really well with breakouts across the board. Here are a few of those financials breaking out of consolidations.

ENERGY

When the world talks inflation I race towards energy too. We've seen energy dominate most of 2021 but back in October we saw some pressure mounting on the energy sector. Regardless, it seems energy has found some strength again. The energy sector broke out of a seven year long descending trendline. The strength is clearly there. The XOP etf on the other hand might be preparing for a break of the descending trendline too.

Energy stocks are a bit more messy than what I'd like to see but the strength is there, a few energy stocks look like textbook breaks out of consolidations.

EUROPE

As a lot of my readers are from the EU, I wanted to briefly include the European markets too. Unsurprisingly, there's not much difference here when compared to the US. The major bond yields in Europe are all breaking out or in the process of breaking out.

The Stoxx Europe 600 banks and oil & gas both showing increased strength. The banks etf has reached a price not seen in more than 4 years and energy is in the process of breaking out which could potentially push it towards the 2018 all-time high. I don't know about my readers but when I see price action like this I'm very bullish.

Do you have an opinion on the current market environment? Or are you eyeing up an interesting stock in the financials or energy sector yourself? Make sure to comment below with your thoughts and ideas, I would love to hear from you!

Great charts!

ReplyDeleteThank you, I appreciate it!

Delete