If you've been keeping up with developed equity markets for a while you must have noticed that the bulk of return was found in the US stock market. Europe by contrast had growth too but very erratic and concentrated to specific industries and stocks. Now, the reason why the US stock market did so well are many but we'll keep it simple, the US had a superior economy. Plain and simple, Americans had more money to spend, that kept being funneled into the profits of all these major American companies.

Technically, this has been going on for over a decade, since 2010 the US has absolutely dominated the developed markets. You can compare any index to that of the US and you will see that the US has been the clear winner for more than a decade. Germany was the last defender but also gave in, in 2018. Now, that doesn't mean that we didn't have opportunities in the European stock markets. Danish equities for example have seen tremendous success the last couple of years but the bulk of return was definitely found in the US and it would have been an immense opportunity cost if you didn't guide your hard-earned capital towards the land of the free.

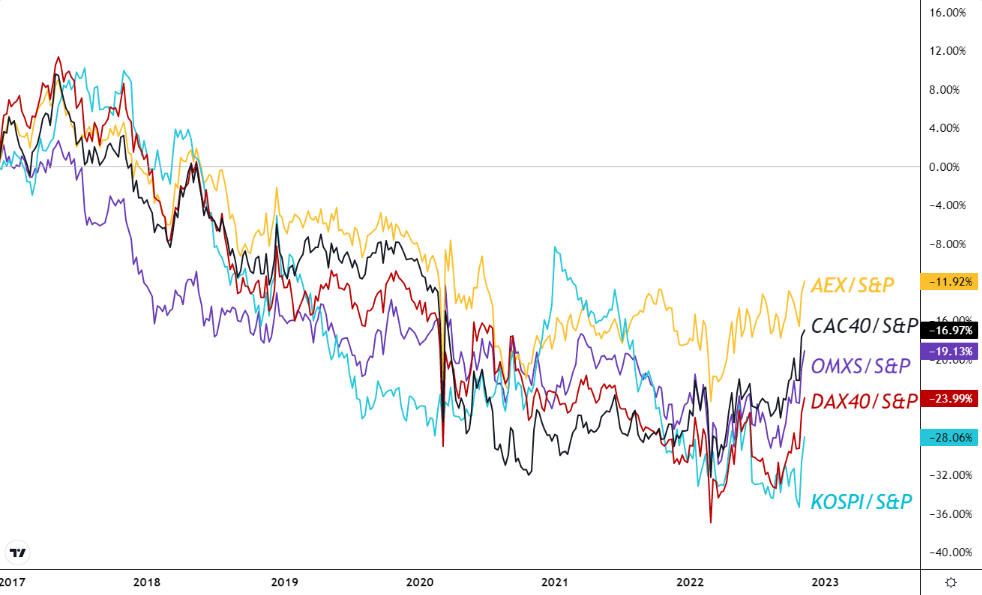

Just take a look at some of these ratios that pits developed market indices to the S&P 500. Every single one has underperformed the SP500 index by quite a margin. Go back to 2010 and the percentages are even worse than what you can see below...There are quite a few more developed market indices that underperformed the S&P 500 that I didn't include in the chart below, but you get the point.

All of this might be coming to an end though based on some interesting developments in the ratio that puts the Stoxx 600 against the S&P 500 to gauge which one outperforms (or underperforms less during declines like we're currently in). Below you can find the Stoxx 600 vs. the S&P 500. As some of my favorite investors say 'before something can start going up, it first has to stop going down' which the ratio below is exactly doing. The range recently broke out together with the seven-year long descending trendline too. Now, these two technical occurrences singled out don't mean much but when you combine them it gets interesting. Combine these technical events together with comments made by Lagarde that they won't just mimic the US Fed's interest rate decisions, which could have further influence on the markets, whether they'll have a positive or negative effect remains to be seen though.

As with every post on this website, I reiterate this is not a signal to start buying up every company that's publicly traded in Europe but it's definitely something to take note of. Because in case Europe does actually start outperforming developed markets we'll be ready to seize that opportunity. What do you think? Do European stocks actually have a chance of outperforming? Or is the war in Ukraine and energy crisis going to weigh them down? Don't hesitate to reach out with your opinion!